We have prepared the following Q & A regarding the newly announced Canada Emergency response benefit.

Canada Emergency Response Benefit (CERB)

The Emergency Care Benefit and the Emergency Support Benefit have been merged into the Canada Emergency Response Benefit (CERB).

This taxable benefit would provide $2,000 every four weeks for up to sixteen weeks for workers who lose their income as a result of the COVID-19 pandemic.

Who is covered by the Canada Emergency Response Benefit?

- Workers who have stopped working due to COVID19 and do not have access to paid leave or other income support.

- Workers who are sick, quarantined, or taking care of someone who is sick with COVID-19.

- Working parents who must stay home without pay to care for children that are sick or need additional care because of school and daycare closures.

- Workers who still have their employment but are not being paid because there is currently not sufficient work and their employer has asked them not to come to work.

- Wage earners and self-employed individuals, including contract workers, who would not otherwise be eligible for Employment Insurance.

Who are the qualified workers?

Qualified applicants need to meet all of the following conditions

- Must be at least 15 year of age who is resident in Canada

- Must have had a total income of at least $5000 for 2019 or in the 12-month period preceding the day the application is made from any of the following sources :

- Employment

- Self-employment

- EI Benefits

- Maternity/Parental leave benefits

- Must cease working for reasons related to COVID-19 for at least 14 consecutive days within the four-week period

- Must not receive any income during the consecutive days on which they have cease working from any of the following sources:

- Employment

- Self-employment

- EI Benefits

- Maternity/Parental leave benefits

When can you apply?

The online portal to apply for CERB will be available in early April with the first CERB payments to come within 10 days of the application, paid every four weeks from March 15, 2020 to October 3, 2020.

How can you apply?

There are two ways to apply for the CERB:

- CRA MyAccont

- My Service Canada Account

What about those already collecting EI?

Canadians already receiving employment insurance (EI) regular benefits and sickness benefits will continue to receive those benefits and should not apply to the CERB. If their EI benefits end before October 3, 2020, they could apply for the CERB once their EI benefits cease, if they are unable to return to work due to COVID-19

What about those EI applications have not been processed yet?

Canadians who have already applied for EI and whose application has not yet been processed would not need to reapply. The claim will be automatically moved over to the CERB.

We attach a CERB flow chart at the bottom for your use.

For more details please visit:

We are here to help!

Please feel free to contact us if you have any questions.

Stay well and healthy.

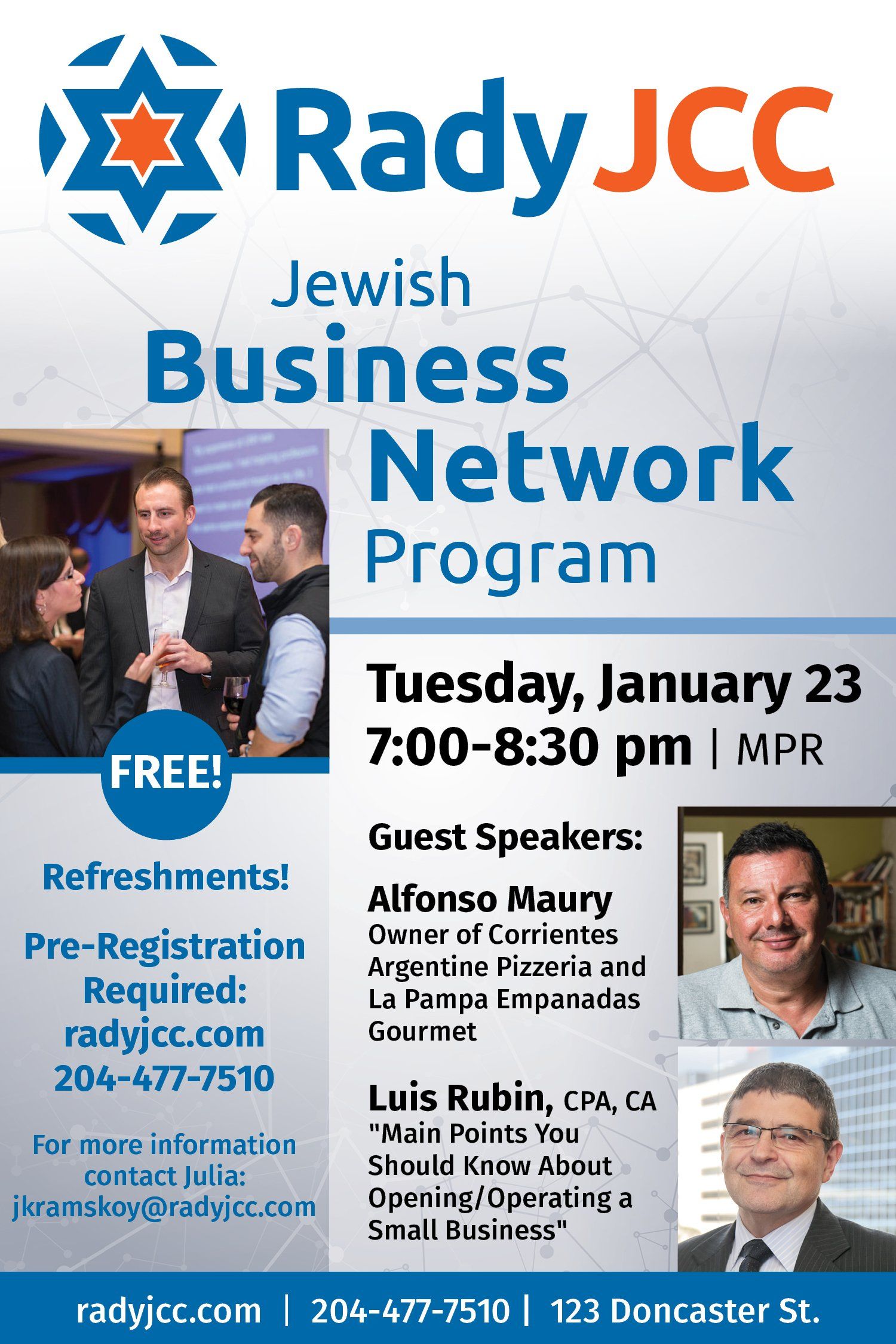

Luis Rubin, CPA, CA

Are you still doing all your paperwork manually? Did you know that there is a better solution.

PCLaw from LexisNexis has the software you need. It is an all-in-one practice management

solution for your company. It lets you gain control over trust accounting, client management, case and matter management, track billable hours, capture expenses, and manage billing and accounting.

The Benefits are:

- Gain a 360 view of all aspects of your practice.

- Track billable hours and expenses, accounts receivable, accounts payable and trust account activity

- Capture your practice in real time through 24/7 remote and mobile connectivity

- User-friendly interface- dashboard

interface works the way you work, visually

The Features

- Trust Accounting – Helps to comply with trust accounting rules that is built into the program. This ensures accurate records transactions and client transfers of client trust funds

- Contact & Client Management- manages your relationships with clients or other parties involved in a matter. Using the automated client intake feature brings clents on board faster

- Case & Matter Management-organizes and stores all information pertinent to a case or matter such as deadline, events, documents, emails, etc.

- Billing – meets specific billing requirements such as flat-fee, retainer, etc. Shrinks billing cycles with standard invoice templates or create new templates or customized bills

- Accounts Payable, Accounts Receivable, Banking-manage vendor payments to improve cash flow –Write and print cheques from trust or general bank accounts-balance accounts and reconcile books. Quickly identify clients with an outstanding balance-helps prioritize

- collection efforts.

- Easy Time and Expense Capture – Track Billable hours and expenses.

- Reporting –with over 50 reports to choose from – helps to proactively identify company health issues before they become problems

- Customize Security Settings-customize your security so as to allow access for firm members with limited access to the company files.

- Integrations-has the capability to

integrate with Quickbooks, Microsoft Word and Excel, PDF and Adobe

- Visual Analytics-quickly analyzes firms time, billing, fees, payment and accounts receivable data using new chart features that can be saved for use in other programs

With all these tasks managed through PCLAW, its easier than ever to keep your trust accounts compliant, gain insight into your firms finances and reduce the time spent on billing and accounting.

Your clients are priority and this gives you more time to spend on their needs.

Luis Rubin is always available to assist you with any or all of the above information. You can reach him by email or by telephone. His contact information in on the home page.

Accordingly, we are suggesting that small business clients consider paying larger than usual dividends to any family member that is over 18 years old in order to maximize the funds available to the family members as of December 31, 2017. The actual amount of dividends should be determined in consultation with our Firm.

Full story in link below:

RST audits can be very stressful and time consuming. Manitoba Finance can look into your company’s bookkeeping and may go as far back as 6 years. To help you with this matter, a few points are provided to help you prepare.

- Unreported tax on personal items.

The RST exemption number is to be used only on items for resale. If the company is purchasing items for

personal use or on business equipment, the sales tax must be self- assessed and reported.

Unreported taxes may be subject to a 50% penalty.

- Resale items used for promotional and/or advertising purposes must

be self-assessed for the sales taxes. This includes out-of-province purchases

such as insurance.

- The RST exemption #’s for your customers must be provided by your

customers and recorded and/or filed. This includes exemptions to Aboriginals,

Farmers and Adult Sized Clothing Certificates.

This would also include delivery outside MB.

- RST has no provision for credits on purchases of sales taxes

paid. Therefore, make sure your

accounting software has the correct settings for the sales tax. An accounting professional can help you with

the setup of you software and cash register/inventory items.

- Taxes paid on exempt goods.

Review you sales/services to make sure RST is being applied

correctly. Make note that some of the

items may be exempt from RST such as Real Property, Direct Agents, Local

Delivery and Service to Custom Software.

Luis Rubin will be happy to assist you with the exempt items to make

sure the RST has been properly applied.

- Taxes overpaid on items sent for consumption outside Manitoba such

as catalogs, supplies and equipment for an out-of-province branch or

office. If unsure, please ask Luis Rubin

once again.

- Poor record keeping. It is

imperative that the items subject to RST are clearly marked within your

company. Setting up accounting software

is best reviewed by an accounting professional who knows the integral part of

the software especially the taxes module set up. If working with inventory, the RST booklet

will assist you in correctly coding the item with the applicable taxes. Services is another item that needs to be

correctly coded.

RST Audits take the owners away from the most important part of their company, servicing clients/customers. Your accountant or business professional can help you with the audit. Make sure all record keeping is in order and accessible to the auditor. Luis Rubin is at the ready to help you with any part of this process.

To be forearmed is to be prepared. If you are unsure of your company’s status in regard to an RST audit, ask your Accounting professional to make sure your company inventory, sales and business practices concerning purchases are looked into and adjusted accordingly. This will give you the peace of mind to know your books are in order.

Luis Rubin can assist you with any and all of your needs with the Retail Sales Tax and also with any other business items that require clarification. Please contact him at 204-944-8000 ext 230, by email at lrubin@rubincpa.ca or fill in website “contact us” form. He looks forward to hearing from you.

There has been a lot of confusion on whether an individual working for a company is considered an employee or a contract worker. The following is the difference between the two from an employer’s perspective.

An employee working for a company has been hired based on a need to hire. This individual would be following the employer’s policies and procedures within the company on time worked, breaks, pay schedule, vacations and sick leave. The individual would come to work at a specific time and be responsible for the duties assigned from his employment contract.

A contract worker is a self-employed individual with special expertise. They would work on a specific task for a designated amount of time set out in the contract agreement with the company. The contract worker would establish his fee based on the task at hand and the time to complete the contract.

The Pros and Cons of Hiring Employees vs Hiring Contractors

The pros of hiring employees.

An employee has more vested interest in your company as the company offers potential security for the employee. In doing so, the employee will put more time and energy in the company thus furthering your company’s goals and participating in company projects. This creates dependable expertise and continuity in customer service. Employees may draw customers and/or clients to your company. People generally prefer dealing with people they are familiar with. Some people are just good at what they do and they bring in business in their own right.

The cons of hiring employees

The employer is responsible for the employer portions of the employee wages such as - Canada Pension Plan-50% employer, employment Insurance -1.4 % of employee premiums. Also responsible for vacation Pay, sick pay and employee benefits- Health, Dental and Life Ins. (should your company establish these). Doing Records of Employment on terminating employees and replacing/retraining employees is time consuming and expensive.

The Pros of Hiring Contractors

Contractors provide staffing flexibility. Most small businesses have busy periods and slow periods.

Freelancers can save you from having to carry employees during slower periods. They can also provide you with the “people power” to take on projects that would normally be too much for your regular staff. Hiring contractors may cost you less than hiring employees.

Should you hire contractor or employee?

The type of business will, most of the time, dictate whether an employee is required or a contractor. A food services business, for example, would not hire contract labour. Hiring a self-employed contractor or employee will depend greatly on what kind of position you are filling.

Luis Rubin can offer his expertise on whether to hire an employee or freelancer. Please call him to discuss the matter in more detail. He will show you, based on your business, which way is more suitable. Please contact him at 204-944-8000 ext 230, by email at lrubin@rubincpa.ca or fill in website “contact us” form. He looks forward to hearing from you.

Many Canadian private corporations will be affected by the proposed changes. The proposals impact the core of Canadian corporate compliance and tax planning that has been in practice. We recommend you to take action during the consultation period to express your opinion.

Many tax payers are requesting the 75 day consultation period to be extended due to the significance and complexity of the changes as follows:

(Source: change.org)

- The consultation submission period be significantly extended beyond its scheduled 75 days.

- The provisions be effective, at the earliest, after being passed into law.

- A robust document identifying each of the significant concerns raised in the consultation be prepared along with alternatives for amendments to the legislation or detailed explanation as to why none is merited.

Many other individuals and organizations are expressing opposition to the proposed changes. Here is a template (not drafted by us) to send to your MP if you are opposed:

(Name) Member of Parliament (Constituency)

(Street Address) (City, Town) (Postal Code)

(Date)

Dear (MP Name),

I am writing as one of your constituents to express my concern about the tax proposals put forth by federal Finance Minister Bill Morneau.

On July 18th, Mr. Morneau made an announcement that the federal government is proposing changes to target what they perceive as tax “loopholes” for the wealthy. These changes would specifically target individuals they deem high-income earners and individuals with corporations or small businesses.

As a small business owner, these changes will impact me directly, and I believe there is a fundamental misunderstanding of the challenges faced by myself and other colleagues.

Business owners in Canada are not afforded the same benefits as public service employees like yourself. I do not receive employment insurance if I fall ill. If I miss work to be with a newborn child, I do not receive any benefits. If I miss work because a family member is sick, I do not get paid. If I find the time to take a vacation, I do not get paid.

Also, professionals in Canada enter the workforce much later than the majority of Canadians, and do so with substantially more debt and this is debt that must be paid back in after-tax personal earnings. After covering basic day-to-day household expenses and increasing housing costs, there is little left for debt repayment, let alone retirement savings.

I also do not receive a guaranteed pension. My retirement is contingent on my own investment choices, and I shoulder the risk associated with these investments with the hope of an age 65 retirement. As of now, the only support I have received from the government was through the use of my small business corporation as a savings tool, and now the finance minister is looking to repeal the last vestiges of tax savings afforded to myself and my colleagues.

Your willingness to take action to support the many small business corporations in your constituency will demonstrate your support for small business in Canada, and will show recognition of the challenges that we face to provide the most basic of needs to the general population. I encourage you to speak with your own physician, dentist, accountant, lawyer, and other local small business owners to hear the sacrifices they have made to get to where they are now.

With a decision on these proposed changes to be made by October, I urge you to take action in support of your constituents and inform Finance Minister Morneau that you do not support these changes due to the impact it will have on small business.

I look forward to receiving a response to this matter.

Sincerely,

(Name)

(Street Address)

(Town, Province) (Postal Code)